Get your tax return done for only 45€/ owner. 60€/ owner If property is shared by two.

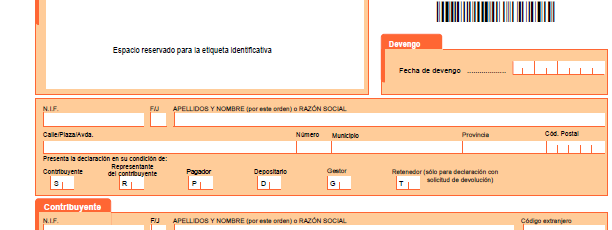

| Non resident spanish tax report. Question and answersSpanish non-resident tax form 210 I think I may have paid this. How can I tell?This non-resident tax issue can be confusing. Why should owning a holiday home entail paying income tax? There is no equivalent in the UK, and no one from the tax office informs non-residents of their obligation to pay the tax and submit the form. In fact, a lot of holiday home owners are oblivious to the requirement or think they have already paid. This is because they have paid local property taxes: Impuestos sobre Bienes Inmeubles (“IBI”). But IBI is another tax that has to be paid by all property owners, residents and non-residents alike. It is set and collected by the town hall, similar to council tax in the UK. It is usually collected every Autumn and you get the amount on an IBI bill through the post. It is generally paid by direct debit from your bank. So if you are a typical holiday home owner, the question to ask yourself is have I paid both my local (IBI) taxes to the town hall and my income tax to the national government (Form 210)? What if I don’t submit a form and pay the tax? The government doesn’t request payment of income tax and many non-resident owners don’t know about it and therefore do not fulfil their obligation to declare and pay it. Initially there may appear to be no adverse consequences, but the tax office (the Agencia Tributaria) know the status of all properties from the IBI and other records and know whether they are owned and occupied. It is a simple task for them to identify which property owners are (a) non-resident and (b) not declaring their taxes. In fact they have recently begun chasing non-payers with letters demanding that non-resident taxes (or resident taxes if applicable) are paid. That said, many people go years without being caught up in tax office investigations. The problem often only rises to the surface when non-residents come to sell their property. In this case the seller is obliged to pay 3% of the sale price to the tax office, which is only recoverable by the non-resident seller when they are up to date on taxes including capital gains tax on the sale and, increasingly, the form 210 tax. This may then require multiple tax returns to be submitted going back several years with fines and penalties. What if I have to catch up on earlier years? You can easily catch up on previous years, but there may be interest costs and penalties . On the plus side, there is a statute of limitations that applies to unpaid Spanish tax which means that tax is not collectable after four years from its due date. If you want advice on the costs and implications of unpaid taxes including back years, send us an email. It may not be as painful as you think, although we do charge an extra € for overdue years as they cannot be submitted online. How does the tax get paid? We include your Spanish bank account details on the tax return so the authorities can deduct the payment automatically. This is done at the end of the year. On the 31st December the tax office will debit the account you have nominated. Can I do it myself?You can access the form (in Spanish) and instructions (in English) on the tax office website here: Agencia Tributaria website – Non-resident Modelo 210 How much is the tax?The tax is calculated as 24.75% of the “income” the Spanish authorities deem you could make renting out the property. This is calculated as 2% of the rateable value (reduced to 1,1% for areas re-rated after 1993). If you only owned the house for part of the year the tax is pro rated to the period of ownership. If there are multiple owners (e.g. husband and wife) they each pay their share of the total tax but must each submit a return. The rateable value is the “valor catastral” found on the IBI (rates) bill you get every year. When is it payable?You must make your return for a given year by the end of the following year, so for the 2017 tax year you are required to declare and pay by 31st December 2018. My lawyer takes care of this. Is that OK?Most law firms offering conveyancing services to foreign property buyers will then offer to become a “fiscal representative” taking care of all related tax affairs. That is fine except that having a fiscal representative is not really necessary if you have simple tax affairs, and it can be expensive. What should I do?If your situation is simple, i.e. you own one property which you do not rent out and have no other complications, then you might want to consider doing the tax return yourself or using a third part to do it. Stick with your fiscal representative if you think they are worth the annual fee, e.g. because they offer valuable advice as well as filing the return or because your affairs are more complicated than the standard holiday property owner. An example of this might be if you rent out your property for part of the year which involves a lot more in the way of reporting . Note that residents of countries without a Spanish tax treaty must have a fiscal representative if they own property in Spain. Most countries, like the UK, have treaties with Spain but tax havens like Gibraltar and some other territories do not. Am I resident or non-resident? A pretty easy question to answer for most of us: if you have a holiday home in Spain which you use periodically but actually live in your home country and pay taxes there then you are non-resident for this purpose. If you live in Spain and only occasionally return to your home country where you have cut most ties then you are more than likely tax resident in Spain and should register as such. Note that failing to register as tax resident does not stop you becoming liable for Spanish resident taxes! Of course there many situations which are not so clearcut, e.g. during a transitional year when you are settling in Spain. The rule of thumb is that spending over half the year in one country makes you tax resident but there are a lot of subtleties and variations. Where your family or business is based can be a factor. If you require clarification contact me What if I rent the house out? This service only applies to the simplest of returns, where the only income is imputed rent, not actual rental income. Non-residents who rent out their property declare the income by submitting a Form 210 quarterly and also paying the 24.75% tax (24% in 2015) quarterly. Owners that are tax resident in another EU country can make some deductions for allowable expenses and the tax rate will be reduced to 20% in 2015 (and 19% in 2016). To take advantage of this you must obtain a certificate of fiscal residence in your home country. Late reporting fines and penalties Anyone missing a Spanish tax deadline risks running up fines and other additional costs besides the tax payable. The system is multi-layered and we have just detailed some of the basics below. In essence though the system punishes the late payer with increasing intensity as time passes and charges additional amounts if the late returns are not made voluntarily. Basic late reporting fine: Within 3 months of due date 5% of tax due Within 3-6 months 10% Within 6-12 months 15% Over one year late 20% Additional interest charge for payments more than 1 year late: 5% Fines for late reporting where no tax is due: €100 (€200 if the Tax Office has prompted the tax payer to make a return) Penalties (“sanciones”) payable if a late return is not made voluntarily * Minor infraction 50% of tax + fine + interest Serious infraction 50-100% of tax + fine + interest Very serious infraction 100-150% of tax + fine + interest The minor penalty is normally applied if there has been no effort on the part of the taxpayer to deliberately conceal income or if the amount of the tax and fines is less than 3.000€. The higher penalties apply when forged documents, false accounting and outright fraud have been used to under declare tax. The higher the proportion of the income fraudulently concealed the higher the penalty. * Note that taxpayers have 4 years to present returns voluntarily and escape sanction, |